| "Inflation is not the result of a curse or a tragic fate but of a frivolous or perhaps even criminal policy." (Ludwig Erhard) |

| "Inflation is always and everywhere a monetary phenomenon." (Milton Friedman) |

| "A place that tolerates inflation is a place where no one tells the truth." (Jerry Jordan) |

| "Price Stability Should be the Overriding, Long-Run Goal of Monetary Policy." (Frederic S. Mishkin) |

| "Борьба с инфляцией и есть борьба за развитие." (Алексей Кудрин) |

According to the Law on the Central Bank, it is stated that "The main objective of Bank of Mongolia is to sustain stability of national currency tugrug" and this statement can be interpreted in two manners. For instance, stability of tugrug in the external market refers to the stability of exchange rate of tugrug in foreign currencies, whereas stability of tugrug in domestic market refers to the stability of Consumer Price Index.

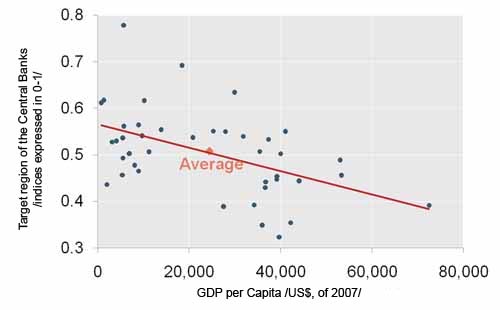

At present, the main objectives of most central banks are focused at sustaining price stability. Study conducted at international levels has concluded that per capita GDP declines as number of central bank objectives (besides price stability) increases.

Source: BIS, 2008 /result of a study on 41 central banks/

For the case of Mongolia, there is not any constraint or limitation on foreign trade, foreign investment and exchange rate flow and hence the capital account of balance of payments is considered to be open. Under this condition of keeping capital account open, sustaining nominal exchange rate stability and controlling inflation rate through interest rate or maintaining an independent monetary policy at the same time creates the "Impossible trinity" (Robert Mundell, Marcus Fleming) puzzle. In other words, all three of the above mentioned tasks cannot be fulfilled at the same time whereas only combinations of either 2 tasks can be sustained simultaneously. In example, open capital account and price stability can be sustained simultaneously, whereas given a sudden deterioration of capital account, nominal exchange rate cannot be held stable. Even though price stability and exchange rate stability do not necessarily follow an inconsistent path, studies on international data has concluded that long term consistency between the two can be seen over more than 5 years of period. On the other hand, shorter term consistency was not observed. Due to these factors, Bank of Mongolia states in the "Monetary Policy Guidelines" to keep inflation rate in an interval and explicitly points out that exchange rate shall be determined according to foreign exchange market supply and demand dynamics.

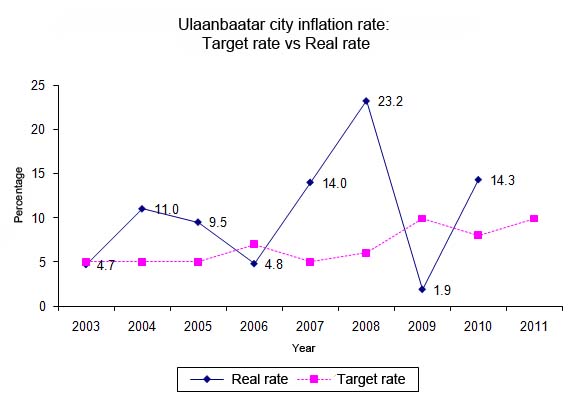

It is stated in the "Monetary Policy Guidelines for 2012" that for the year 2012, consumer price inflation shall be kept at a one digit level and for the year 2013, it shall be kept under 8 percent, whereas exchange rate shall be determined in accordance to "fundamental macroeconomic factors in a flexible manner". In other words, price inflation of goods and services in consumer basket shall be kept under 10 percent in 2012. In case of nominal exchange rate sustainability, it should not be considered as fixed nominal exchange rate, rather flexible exchange rate without sudden fluctuations.

A couple of studies such as Levine (1997), and Khan and Senhadji (2000) conducted on economic growth and inflation data of more than 140 economies has been considered a classic in the science of economics. Based on a careful and meticulous study on vast database, inflation rate which has no negative effect on economic growth has been found to be 1-3 percent for developed economies and 7-11 percent for emerging economies. For instance, inflation rate in Euro zone economies is targeted to be less than 1.5-2 percent and for Chili, an economy highly dependent on copper price, inflation rate is targeted to be less than 3 percent.

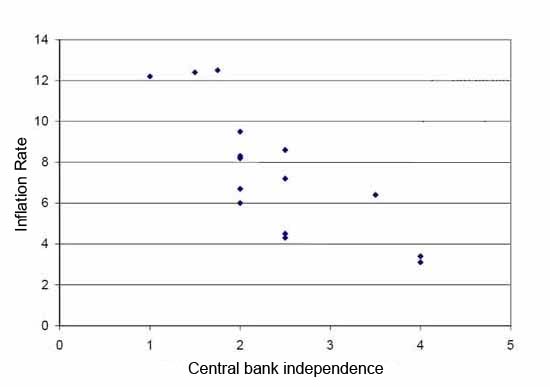

Failure to meet inflation targets is one implication of failure to achieve Central bank independence, fully. Study on international data has shown that economies with rather independent central banks successfully keep inflation rate at lower levels.

Central Bank independence and inflation rate (1973-1988)

Source: IMF, Summers and Heston, OECD

Changes in monetary policy instruments have time lagged influence on inflation. For Mongolian case, this time lag is found to be around 1 year. Moreover, since the mid 2000’s correlation between money supply and inflation has declined, hence the need to reform the monetary policy method has emerged.

Under this condition, the action of Parliament in changing targeted inflation rate each year is causing to diminish the time frame that monetary policy instrument starts to take effect, to miss inflation target from the beginning, to lose central bank independence and hence to reduce the credibility of the central bank.

As a solution to the above mentioned hindrances, Bank of Mongolia had proposed to the Parliament in the project of "Monetary Policy Guidelines for 2008" to set targeted inflation rate at 6 percent on average during the years 2008-2010.

Unfortunately, the proposal was not encouraged at the Parliament; hence starting 2009, the Parliament has shifted back to the older version of setting inflation rate target each year.