According to the Law on Central bank, the Central bank activities shall be independent from the Government. This clause complies with the international standard. How the independency of the Central bank, especially the independency of monetary policy should be understood as?

Independency of what?

The main objective of monetary policy pursued by the Central bank is sustained low inflation. If the Central bank can define its objective of price stability independently without any influence from external forces, then the objective of independency is considered to be being attained.

The European Central Bank and the Reserve Bank of New Zealand have obligations for the annual inflation rate to be not exceeding 2 and 3 percent respectively, by law. These banks are not able to define their objectives themselves; which implies that their objective of independency is not being fully met. The opposite example of this is the US Federal Reserve. The Federal Reserve is provided with the ability to define its objectives independently since the law states the objectives of Federal Reserve in a general manner.

There is no specific targeted annual inflation rate stated in accordance with the Law on Central bank (Bank of Mongolia). On the other hand, the targeted inflation rate proposed by the Bank of Mongolia is officially approved only after being discussed at the Parliament of Mongolia. This implies that the objective of independency is not being fully attained for the case of Bank of Mongolia.

Another concept concerning the independency of monetary policy is the concept of operational independency. If the Central bank has the right to utilize any of the monetary policy operational tools (either monetary aggregates, interest rate or exchange rate targeting or targeting combinations of these) in curbing inflation, its monetary operational independency is considered to be being fulfilled. Bank of Mongolia’s operational independency is being attained by specifying the monetary policy tools to be utilized by the Bank of Mongolia broadly in the Law on Central bank.

Independent from whom?

Although it is stated by law that the operations of Central bank shall be independent from the Government, there are several factors that limit the independency of the central bank specified by law. In the case of fiscal policy stance not being achieved, the Government’s interest to finance budget deficit by Central bank loan increases. It is specified that the amount of Central bank loan issued to the Government shall not exceed 10 percent of the average of the past 3 years’ budget revenue in the Law on Central bank (Bank of Mongolia). This condition is not only hindering the development of Government security market, but also burdening the process of the financing being accumulated without any inflationary pressures.

Another example is the fact that certain business groups trying to get concessional or "policy" loan from the Central bank by lobbying the Government. Such types of loans lead to lots of negative outcomes such as inappropriate usage of loan, financial discipline being lost, deterioration of loan repayment, and a significant increase in the budget deficit.

According to the Government’s direction given to the Central bank during a particular period in the past, policy loans were issued to metallurgic, meat, mining, flour industry and construction companies. Most of these loans had not been repaid according to schedule and had been solved through court.

The significance of independence

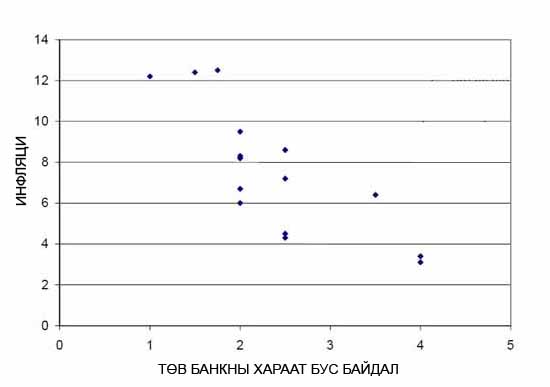

Based on studies on international data, it is proven that the inflation of countries, in which the central banks are considered to be independent, are usually low.

Central bank independency and inflation rate /1973-1988/

Source: International Monetary Fund, Summers and Heston, OECD

In truth, the main contribution of the Central bank for the country’s growth and development is to facilitate the formation of public trust in their future by creating expectations of stable price level. Such price stability provides an incentive to gain from savings, investment and productivity which are essential to economic growth. In addition, sustained low inflation positively influences allocation of income. This is because employment level rises and real income earned by vulnerable part of society is maintained due to sustained low levels of inflation.

Though it has been stated that the Bank of Mongolia shall operate independently in the Law of Central Bank, it is very difficult to conclude in reality, that monetary policy is being implemented independently. The independency of Central bank shall be governed by law and be exempt of budgetary and political pressures. In other words, the economic (objective) and the political (operational) independency of Central bank should be legalized by law.

The main objective of the Central bank and the policies being implemented to reach such objective are evaluated based on whether they are independently determined. Due to lack of knowledge regarding monetary policy and its final objectives, there are increased responsibilities that are irrelevant to monetary policy operations being levied to the Central bank. This could lead to negative consequences of not being able to define and implement policy measures and operational instruments independently by the Central bank. Without being able to select operational tools of choice independently, Bank of Mongolia could not be exempt from political and budgetary pressures.